We surveyed Directors and CEOs from 80 retail businesses to understand the response that they’ve taken to COVID-19 and gain insight into what they plan to do in response.

We will continue to report in more depth in weeks to come and the key insights include:

Impact to performance and operations

Nearly 75% of respondents have seen sales drop significantly as factories, warehouses and stores have closed. However, e commerce and customer acquisition has increased by more than 50% in most categories:

- 71% are trading significantly below target

- 79% of the retailers who participated have closed stores, concessions or consignments

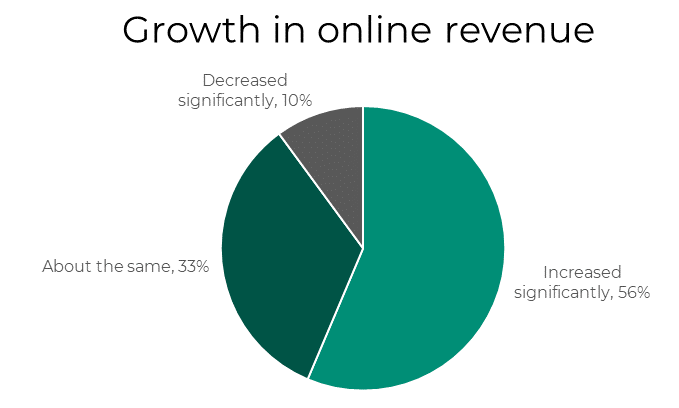

- 59% of respondents have had a significant increase in registered customers and 56% have seen significant growth in online revenue (38% in the apparel sector)

More than 90% of respondents have had some difficulty with inventory availability and fashion retailers have had to reduce supply:

- 92% reported that there have been some difficulties with maintaining supply or receiving goods from countries of origin.

- 46% reported that the impact has been greater than expected

- 88% of apparel retailers re phased or cancelled supplier orders (vs 61% across all categories)

- 52% closed Factories or Warehouses

Rapid change to operating models: Trade

The sector has changed rapidly, implementing new ways to trade:

- 48% launched new websites. The category spread for this was wide, reaching across 12 product categories

- 32% created new affiliations

- 21% introduced new products and services

- 44% introduced new home delivery models

- 48% increased digital marketing initiatives

- In the commentary, respondents referred to a range of new marketing and sales initiatives including:

- Selling via WhatsApp

- Accelerating M-Commerce

- Increasing E-commerce capacity

- Introducing Live Chat

- Introducing contactless delivery and collection

- Shifting from wholesale and introducing new Direct to Consumer channels

Rapid change to operating models: People

The sector has changed rapidly, implementing new ways of working together. Where possible, businesses have taken advantage of government schemes to retain employees and preserve cash. They have also implemented new measures and practices to look after people:

Remuneration has decreased temporarily:

- Most respondents have furloughed staff in markets where this is an option: 68% (70% in Apparel) and 73% have cut contracted labour

- There has been very little redundancy or unpaid leave, (only 16% and 12% respectively)

- 52% are paying bonuses to staff who are working ‘at risk’, for example in warehouses or factories

Illness has had some impact, 32% reported that colleagues have had to self-isolate

Offices have closed to protect staff:

- 50% reported that for health and safety reasons they closed factories or stores which they could have legally/technically left open

- 90% closed head offices and 92% closed their contact centres

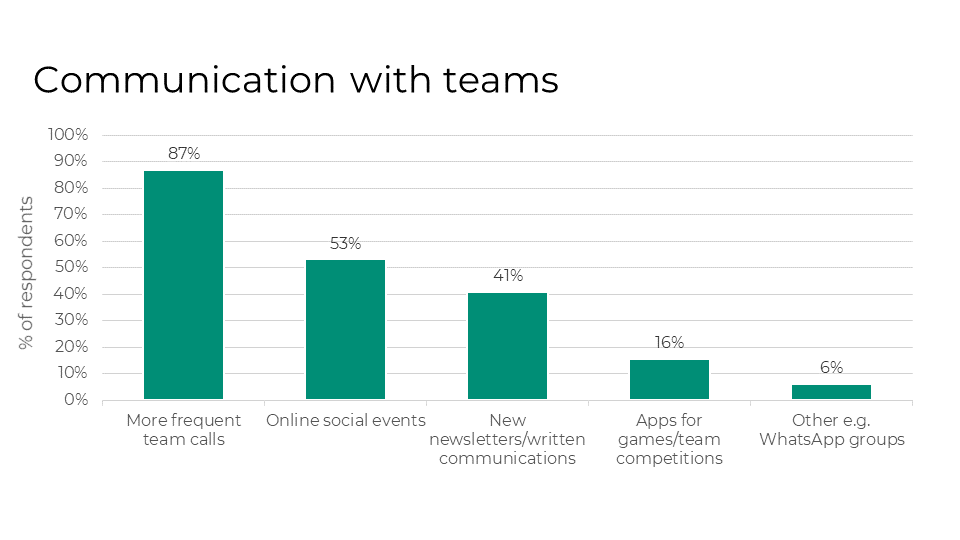

Communication with teams has increased:

- 87% are communicating more frequently with their teams

- 53% are holding online social events

- 41% have launched new newsletters and written communication

Outlook post lockdown

There are mixed views on remote working:

- 76% have implemented new tools to support home working

- 46% think that remote working has increased productivity, 21% think productivity has decreased, 19% say there has been no impact and 13% are unsure

- 35% think that office working will not resume as it was pre-Covid, 32% think it will and 32% are unsure

57% say that they have not made a plan for exiting from lockdown, that instead they will respond as the situation unfolds.

32% are developing a new operating model for the future, that is ‘significantly different’.

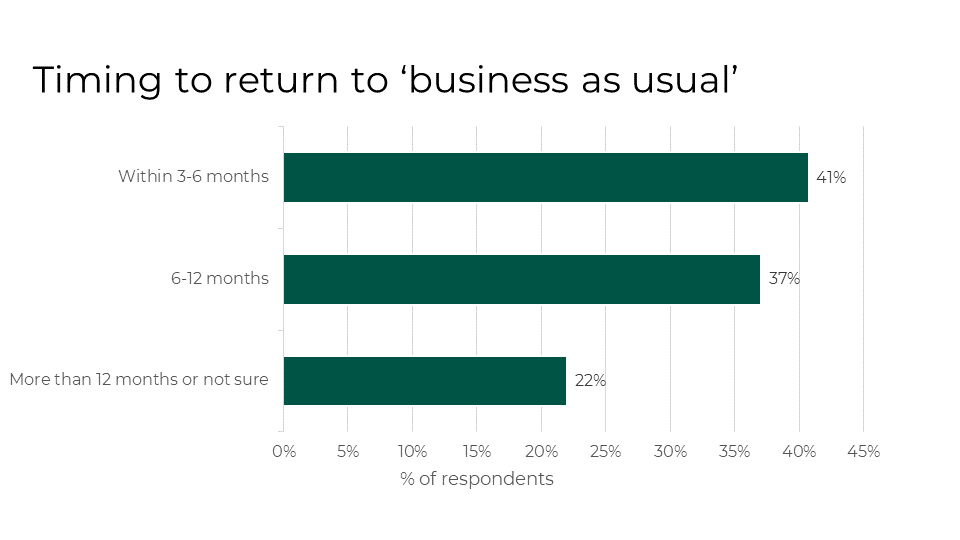

41% expect to be back to ‘business as usual’ within 6 months post-lockdown.

We will be releasing more insights in the coming weeks, so follow us on LinkedIn.